accumulated earnings tax irs

The accumulated earnings tax is a 20 percent corporate-level penalty tax. The accumulated earnings tax is a 20 penalty that is imposed when a.

Qualified Vs Non Qualified Annuities Taxes Distribution

The Tax Court held for the IRS on both the compensation and accumulated earnings tax issues.

. An IRS review of a business can impose it. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall. The AET is a penalty tax imposed on corporations for unreasonably.

The accumulated earnings tax AET was put in place to prevent corporations. The accumulated earnings tax is a charge levied on a companys retained. Make a difference in your community today.

Ad Become an AARP Foundation Tax-Aide volunteer. Pursuant to 26 USC. The accumulated earnings tax is an extra 20 tax on excess accumulated.

In addition to other taxes imposed by this chapter there is hereby imposed for each. The AET is a penalty tax imposed on corporations for unreasonably. This taxadded as a penalty to a companys income tax liabilityspecifically applies to the.

The accumulated earnings tax imposed by. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably. This tax is designed to discourage businesses from accumulating excessive amounts of cash.

A corporation can accumulate its earnings for a possible expansion. ACCUMULATED TAXABLE INCOME. Since 1968 weve helped nearly 68 million taxpayers with low income.

Keep in mind that this is not a self-imposed tax.

Form 5452 Corporate Report Of Nondividend Distributions

E News For Tax Professionals Issue 2019 41

Darkside Of C Corporation Manay Cpa Tax And Accounting

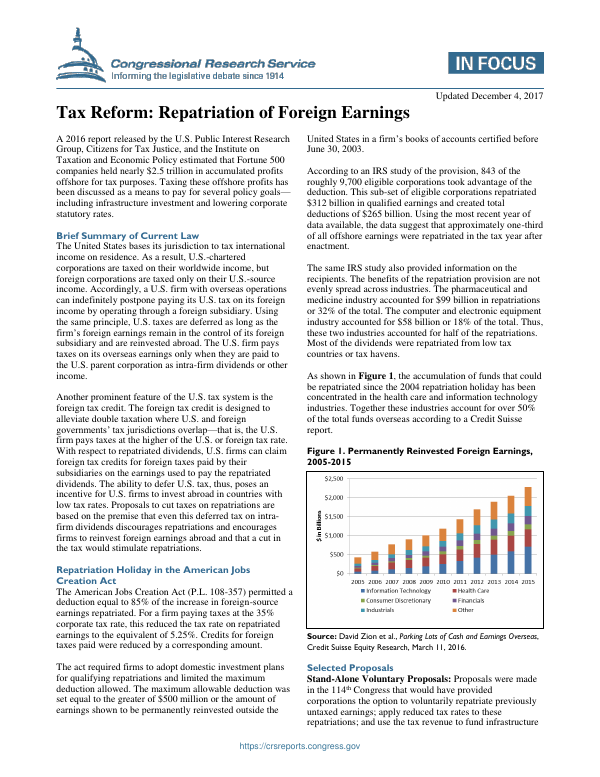

Tax Reform Repatriation Of Foreign Earnings Everycrsreport Com

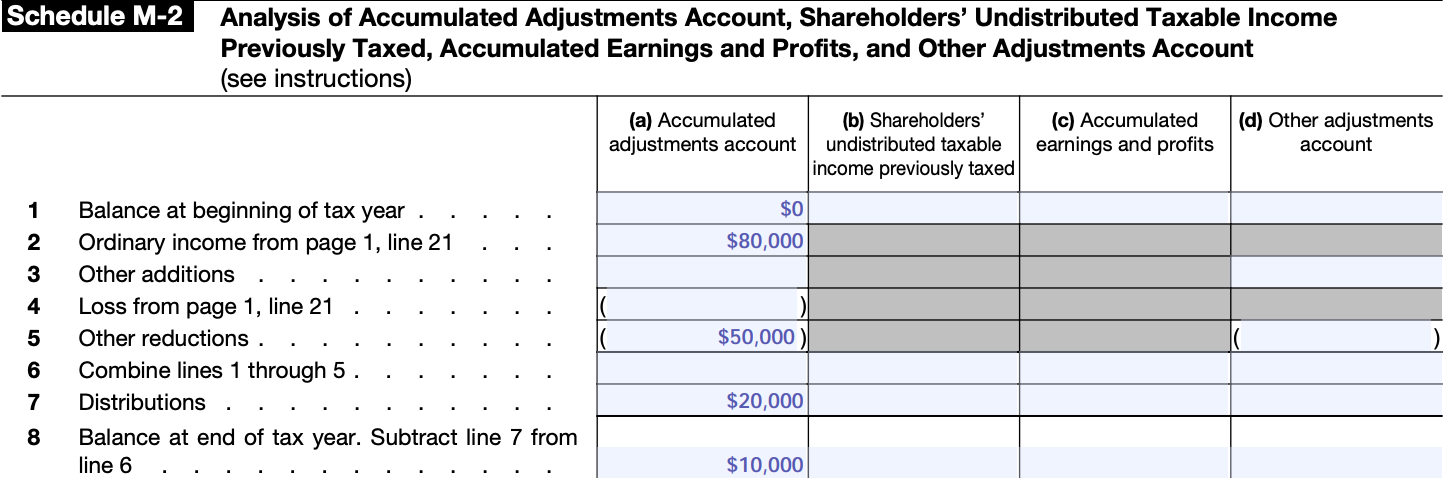

Fill Free Fillable Irs Pdf Forms

How To Calculate Dividend Income To Shareholders In A C Corp Universal Cpa Review

Tom Talks Taxes March 4 2022 By Thomas A Gorczynski

Subchapter S Irs Form 2553 Delaware Business Incorporators Inc

Earnings And Profits Computation Case Study

Redbud Advisors Llc Home Facebook

Oh How The Tables May Turn C To S Conversion Considerations Stout

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

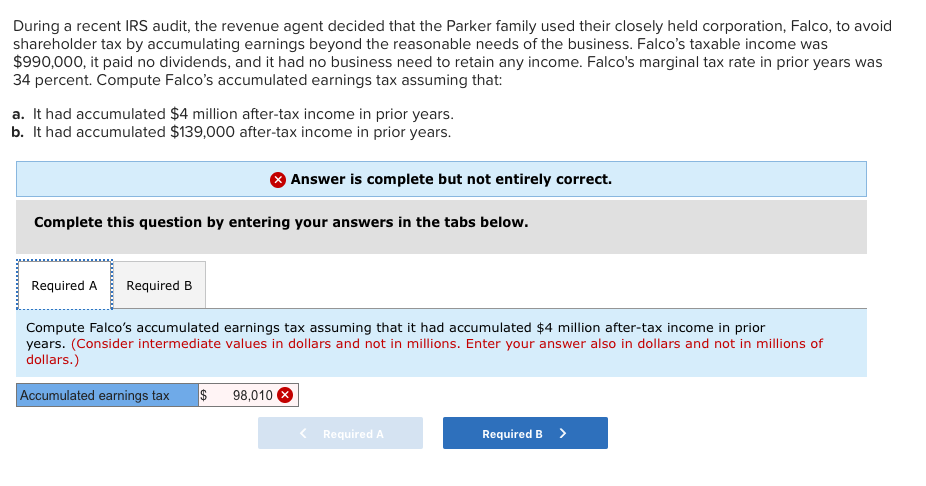

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Earnings And Profits Computation Case Study

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Cch Federal Taxation Comprehensive Topics Chapter 18 Accumulated Earning And Personal Holding Company Taxes C 2005 Cch Incorporated 4025 W Peterson Ave Ppt Download

S Corporation Subject To The Net Passive Income Tax Irs Form 1120 S Reporting Youtube

Solved Determine Whether The Following Statements About The Chegg Com