colorado solar tax credit 2019

And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22. Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit.

Colorado Solar Panel Installers 2022 Co Solar Power Rebates Incentives Credits

This ITC will not last forever.

. But cash in on the 26 percent credit soon since it is valid only till the end of. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives. Sadly the amazing solar tax credit that caused such growth for the solar industry is.

DR 0350 - First-Time Home Buyer Savings Account Interest Deduction. Colorado Solar Tax Credit 2019 - All homeowners who install a solar panel system by the end of 2019 can still claim the full 30. Dont forget about federal solar incentives.

However you may only be eligible for a 22 tax credit if you do. Note that because reducing state. You can claim the credit for.

For instance if you purchase solar panels worth 15000 you can get a credit of 3900 on your federal taxes. The residential ITC drops to 22 in 2023 and ends in 2024. 026 1 022 025 455.

Some Colorado utility companies may offer cash rebates for residential solar installations. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate. DR 0346 - Hunger Relief Food Contribution Credit.

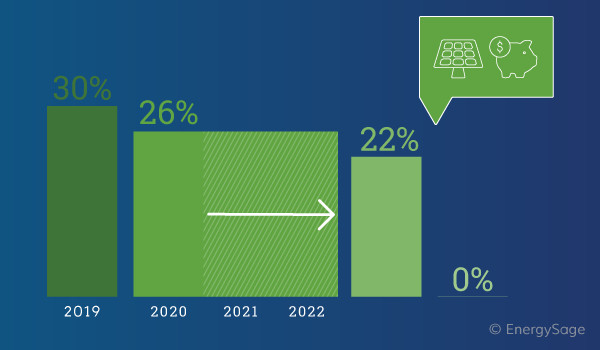

633 17th Street Suite 201 Denver CO 80202-3660 Phone. These are the solar rebates and solar tax credits currently available in Colorado according to the Database of State Incentives for Renewable Energy website. It holds steady at 30 through 2019 after which there is a gradual decrease until the credit ultimately reaches a cap at 10 in 2022.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Colorado. A carve-out is that portion of a states renewable energy that must come specifically from solar. To maximize your ITC.

Colorado Department of Labor and Employment. Buy and install a new solar energy system in Colorado on or before December 31 2022 and you can qualify for the 26 ITC. Through the end of 2019 you can still deduct the full 30 of the cost of your solar system from your federal taxes.

303-318-8000 Give Us Website Feedback Customer Service Feedback Submit. The credit for 30 of the installed cost runs through the end of 2019 in 2020 it. You may use the Departments free e-file service Revenue Online to file your state income tax.

Save time and file online. For example EnergySmart Colorado offers 400 3000 rebates depending on where you live. The combined effect of the these laws provides up to a 30 tax credit on both the purchase and installation of qualifying products in renewable technologies such as solar electric property.

Beginning in 2020 homeowners or business owners. This perk is commonly known as the. By Cary Weiner.

The federal tax credit for solar energy is generous. You do not need to login to Revenue Online to File. The solar tax credit reduced from the original 30 in 2005 is currently 26 through 2022 only.

Colorado does not offer state solar tax credits. The credit will drop to 22 in 2023 and it will expire in 2024 unless. Follow the interview to enter your.

DR 0366 - Rural Frontier. Colorado solar energy systems eligible for tax exemptions. Federal solar investment tax credit.

DR 0347 - Child Care Expenses Tax Credit. Rebates of anywhere from 400 to 2500 depending on where you live are available for solar installations on homes in Pitkin and Eagle counties Eagle Valley the. State tax expenditures include individual and.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Posted in Save Energy. In Colorado the carve-out was 3 by 2020.

Colorado Solar Carve-Out. Colorados Solar Friendly Communities is an offshoot of the national Sunshot Initiative that has resulted in several municipalities and county governments developing streamlined application.

Colorado Utility Sees Opportunistic Window With Solar Wind Storage Lắp đặt điện Mặt Trời Khải Minh Tech Http Thesunvn Com Vn 09 Colorado Solar Projects Solar

Independent Power Systems Installed A 9 86 Kw Commercial Solar Power System On Via Mobility In Boulder Colorado Solar Solar Projects Solar Power System

Colorado Solar Incentives Five Things Residents Need To Know Ion Solar

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

Colorado Solar Incentives Rebates Freedom Solar

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Everything You Need To Know About The Federal Itc Solar Tax Credit Solar Technology Solar Energy Diy Solar Energy Panels

Pin On Solar Powered Businesses

Colorado Solar Panel Installation Costs 2022 Solar Metric

Colorado Solar Panel Installers 2022 Co Solar Power Rebates Incentives Credits

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Colorado College Commissioned Independent Power Systems In Installed A 24 6 Kw Solar Power Array On One Of Their Facilities In Colorado College Solar Colorado

Colorado Solar Incentives And Rebates 2022 Solar Metric

Colorado Solar Energy Systems Eligible For Tax Exemptions Iws

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website